A portfolio approach to corporate social investment

Using a combination of social investment approaches as part of a well-managed portfolio can help corporates to maximise the benefits of their social investment activities to both the business and to

- Adopting a combination of approaches in a corporate social investment portfolio can deliver the best results in terms of both business and social outcomes.

- To maximise impact, companies need to have clearly defined portfolio objectives, and actively manage their portfolio to keep it aligned with those objectives.

- Understand some steps and frameworks for companies to increase the impact of their social investment portfolio.

Businesses in Australia and around the world are recognising that corporate social responsibility (CSR) is a core part of business. According to the recent 2016 PwC Global CEO survey, 64% of CEOs said that corporate social responsibility is core to their business rather than being a stand-alone program.[1] In Australia, 89% of the respondents to a survey last year into shared value reported that a social focus was included within their company strategy.[2]

… combining different approaches can deliver greater impact, support the generation of social and business value in different ways and engage different stakeholders.

Concurrent with this shift, corporates are increasingly improving their social purpose strategies: seeking to achieve greater impact from their investments, adopt new approaches, and better understand the outcomes that their investments achieve. We have shared our perspectives on how corporate funders should manage to outcomes.

There are many ways to carry out corporate social investment – from traditional philanthropy to shared value – all of which have their own benefits. So what approach should you adopt? The answer is that companies don’t have to choose: a well-managed portfolio combining different approaches can deliver greater impact, support the generation of social and business value in different ways and engage different stakeholders.

In this article we look at which combination of approaches should be pursued, and how to get the most value out of them.

There are many ways for companies to pursue a social purpose

One challenge that corporates face in advancing their social investment and community strategies is that there is an abundance of ways to be a socially responsible business.

What gets lost in all this hype is the value of good old CSR 1.0 and traditional philanthropy.

In the traditional philanthropy and CSR approach, businesses have long engaged in things like annual charitable donations, perhaps a local community grant program, and supported employee volunteering and fundraising initiatives. Many corporates nowadays are more targeted with their social investments – such as developing multi-year community partnerships that involve both funding and skilled volunteering, and catalysing social innovations that aim to provide new ways to address social issues. The latter has been promoted by Mark Kramer as ‘catalytic philanthropy’[3], and other sector leaders have commented on the shift from CSR to CSR 2.0[4] and even CSR 3.0[5], which promote increasing integration of CSR with the business. But what has been most acclaimed in recent years is shared value, and its potential to address the most challenging social issues of our time by generating economic value in a way that also produces value for our society.

What gets lost in all this hype is the value of good, old CSR 1.0 and traditional philanthropy. Traditional philanthropy has some general advantages: it is relatively easy to undertake, can be tax deductible, and requires less effort and commitment across the organisation. However, this simple philanthropy can also create a strong base for building a company’s reputation and engaging employees.

Katarina Persic, Head of the Toyota Community Foundation, believes that it is their local community and employee grant program which gets the most recognition internally. Despite total community investments of approximately $2 million per year, she says that “the $1000 grants we give out are the most satisfying part of the Foundation to our employees”. Toyota makes about $40,000 per year available to employee-nominated charities through one-off grants of up to $1000.

Putting practices old and new together, we have seen that corporate engagement in social issues generally falls within four categories see table below.[6]

| Traditional philanthropy | Engaged philanthropy | Catalytic philanthropy | Creating shared value | |

|---|---|---|---|---|

| Key question | Which organisations should we support and how much money should we give them? | How do we work with and support a small group of partners to deliver a discernible social impact? | How can we catalyse a campaign that achieves a measurable impact? | How can we design a business strategy that creates economic benefit by addressing social problems? |

| What is funded | Specific programsEquipment | Organisations (capacity-funding)Outcomes (strategic plan funding) | Multi-sector campaigns | Opportunities for growing the business that aim to solve social problems i.e. value chain re-engineering |

| What is ‘given’ | Primarily money and some time | Giving money, time, information, networks, skills, goods, services, influence and voice | Leadership and coordination, money, research and knowledge, networks, new business models, influence & voice | Value creation for customers, community, suppliers such as new products and more sustainable processes |

| Area of impact | Broad-based, spread across several issues | Focused on target areas or issues | Focused on a single systemic issue | Creating social value that aligns with business objectives |

| Nature of support | ‘Giving’ or ‘donations’ in response to requests or crisesOrganised funding rounds | Strategic partnerships involving larger multi-year grants | Leader and catalyst for change, involving strategic partnerships and large on-going support | Cross-sector partnerships and collaboration |

| Number and depth of partners | Typically, many funding recipients receiving a relatively small amounts, generally in one-off grants | Typically larger grants over multiple years, potentially to fewer recipients | Typically cross-sector collaborations involving multiple partners focused on a single issue | Numerous partnerships with customers, community and supplier stakeholders |

So which approach is best? The answer is that companies don’t have to choose. Each approach can support the generation of social and business value in different ways and engage different stakeholders. Using two or more approaches together can deliver greater, and a broader range of, benefits. The more important question then is which combination of approaches should be pursued, and how to get the most value out of them.

Solution: managing a portfolio of corporate social investments

In the 2015 State of Shared Value survey[2], 46% of companies responded that they were pursuing shared value or had in the past. However, 54% were doing CSR, 39% philanthropy, 29% have a corporate foundation,12% engage in impact investing, and 5% were also doing something else. Sixty per cent of companies said they did three or more of the above.

Many corporates are managing a variety of programs and initiatives that aim to achieve a social good. Nathan Barker, Executive Manager of Community Investments at Commonwealth Bank, believes that having a range of approaches allows the company to broaden their stakeholders, form non-traditional alliances, and align diverse skillsets.

Having a variety of strategies allows companies to:

- Appeal to different sets of stakeholders

- Achieve a broader set of social and business outcomes

- Diversify the risk in achieving the social and business objectives

- Make use of a wider range of skillsets across the organisation

- Take advantage of different available opportunities, and

- Design complementary initiatives which increase the overall impact of the portfolio.

However, a common challenge faced by these corporates is how to optimise and streamline this portfolio, to ensure that what is included will deliver maximum value towards its social and business objectives. Having a well-managed social investment portfolio means that the organisation needs to:

- Have clearly defined social and business objectives for the portfolio

- Understand the type of value that each program or initiative delivers, who the stakeholders are, and how well it aligns with the defined social and business objectives

- Actively manage the portfolio, so that new investments most aligned with the objectives are introduced, ways to get more value out of existing investments are explored, and that legacy programs which are not aligned with the objectives are phased out.

How companies are getting smarter with their portfolios

SVA has recently supported MyState Limited and the Commonwealth Bank in their community and corporate responsibility work, and engaged with the Toyota Community Foundation to understand their new portfolio strategy. Each currently invests in a range of programs and initiatives, and is seeking to get greater alignment and impact from its portfolio.

MyState Limited and MyState Foundation

MyState Limited is a financial services institution with a long history of supporting the Tasmanian community. In addition to a range of community sponsorships, the business supports staff volunteering and fundraising, branch donations, and works with the MyState Foundation to administer its annual community grant program. The grants program funds organisations delivering programs for young people in a range of areas, up to the value of $10,000.

Chris Thornton, GM of Product and Marketing, wanted the Foundation and broader community engagement activities to be a far more integral part of MyState Limited’s identity and purpose. SVA supported MyState to develop a new community strategy which articulates the social focus and business objectives, and aims to deliver greater social impact by introducing more engaged philanthropy approaches to complement the traditional model.

From 2016, MyState is planning to develop partnerships with key community organisations, providing them with multi-year funding towards addressing educational attainment and employment for young people facing disadvantage in Tasmania.

“… we’re ready to invest in innovations and demonstration projects that will use our expertise to address social issues.”

The Toyota Community Foundation

The portfolio of the Toyota Community Foundation currently includes traditional philanthropy approaches such as local council grants, employee-nominated community grants, and matched employee donations, as well as a more engaged philanthropy model of partnerships which provide multi-year funding and capacity building to non-profit organisations. The partnerships are focused on three social issues that intersect with the business: road safety, education, and the environment. In addition, the Toyota Production System Support Centre (TSSC) is a department within the business which provides pro-bono support to non-profit organisations in process improvement – leveraging the specialist expertise from Toyota’s 50 years of auto-making.

Recognising the opportunity to create greater impact using Toyota’s skills and expertise, the Foundation is planning to introduce a Community Innovation Fund to develop projects addressing mobility by 2018.

Katarina Persic, Head of the Toyota Community Foundation, says that while their current grants programs are hugely important for engaging the local community and employees, “we know that small grants and even partnerships with existing organisations will not solve the problem – we’re ready to invest in innovations and demonstration projects that will use our expertise to address social issues”.

Commonwealth Bank

Managing a broad portfolio, Nathan Barker, Executive Manager of Community Engagement at Commonwealth Bank (CBA) wanted to “ensure that the whole portfolio is driving change, and gain the confidence that we are investing appropriately and making good decisions.” He also believes that outcomes measurement is critical to ensuring their work is having the impact that they expect.

SVA helped CBA to articulate the intended impact for their entire corporate responsibility portfolio using a logic model. We then developed an outcomes management framework to support CBA to track and illustrate progress against their intended impact, and a decision-making framework to guide their investment allocations within the portfolio. CBA is using the frameworks to make strategic decisions to improve their impact and to ensure that they are investing responsibly for impact.

Steps towards a well-managed social investment portfolio

Given the benefits and challenges of a portfolio approach, how can businesses go about it? Essentially, the principles that would apply to managing a social investment portfolio are the same as those used in managing a business portfolio. Each investment should be included based on its potential to achieve the defined social impact and business objectives, although the balance of social versus business value, and the type of impact each investment is expected to contribute, may differ from one investment to the other.

You need to have clarity on the purpose of each program and activity, no matter how many and varied.

A range of frameworks and tools can provide guidance on developing or streamlining a portfolio of corporate social investments. The following steps and examples may be useful for:

- Defining the social and business objectives of the portfolio

- Managing for alignment of the initiatives with the objectives

1. Defining the social and business objectives of the portfolio

Clarity on the social purpose. The first step is to figure out what impact you want to have. One way to think about what social issue to focus on is by considering three questions: What does our society need? What does our business need? What are our capabilities towards addressing the social issue? (See Figure 1.)

These questions may be interpreted differently depending on the context. For example, the Origin Foundation focuses its investments on education. This was arrived at through employees’ choice, considering social research, and the broad recognition that by contributing to better education outcomes through philanthropy, there will be intangible benefits to the business.

Clarity on the business objectives. The next step is to articulate the business motivations. Numerous perspectives already exist on how to codify a company’s motivations for societal engagement. For example, the global Committee Encouraging Corporate Philanthropy (CECP) in the US highlights four categories: enhancing employee engagement, building customer loyalty, managing downside risks to the company’s reputation, and contributing to business innovation and growth opportunities.[7]

US-based consultant for social leaders, FSG recommends three categories: supporting community and causes, engaging key stakeholders, and incubating shared value.[8] Additionally, all three motivations can potentially deliver a cross-cutting business benefit: building the company’s brand and reputation among consumers and key stakeholders.

The Australian Centre for CSR (ACCSR) has been tracking CSR practices, trends and capabilities in Australia through an annual survey since 2008, and in 2016 reports that consistent with previous years, building stronger relationships with stakeholders remains the highest CSR priority for organisations.[9]

Clarity on the approaches we are willing to take. Questions to think about here include ‘How risk averse are we?’ ‘What won’t we invest in?’ ‘What do our stakeholders expect from us?’ It may be useful to consider the level of engagement and responsibility involved in each approach – for example, in traditional and engaged philanthropy, it is the grantees and partners that are responsible for the investment’s success. In a catalytic or shared value approach, this accountability lies with the organisation.

2. Managing for alignment of the initiatives with the objectives

Once the objectives and parameters are clear, an organisation can then understand how well a set of current initiatives aligns with them, and streamline and improve the portfolio.

Assessing the alignment of each initiative with the objectives. This could be as simple as putting up each initiative against each objective and ticking whether it aligns or not, or a more detailed rating of how much they are aligned.

For example, Westpac’s social impact assessment tool is an online tool that helps employees and the community assess a potential initiative based on alignment with Westpac’s social impact focus areas, as well as alignment with the company vision, business strategy, core business skills and resources.[10] Users can rate alignment with each criteria as none, low, medium, or high.

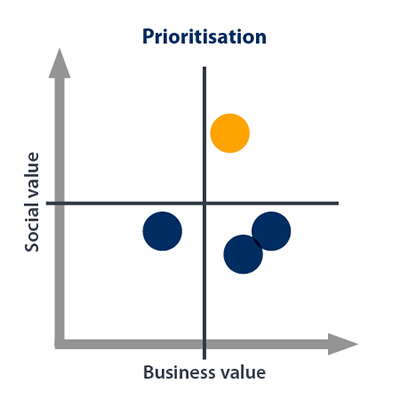

Comparing the value of each initiative. Once there is a way to score each initiative, they can be summarised and compared against each other. For example, we supported CBA to develop a decision-making framework which includes a way to prioritise the initiatives using a simple matrix to plot the social and business value (see Figure 2).

Conclusion

Corporates are wanting to be more strategic and to get more value out of their social investments. While there is a lot of recent interest in ‘shared value’ and ‘catalytic philanthropy’, more traditional philanthropy and CSR remains important, and all these approaches can work alongside each other in a well-managed portfolio of social investments.

What’s most important when a business takes on a range of investments is that there are clearly defined social and business objectives, and clarity on how each program or initiative in the portfolio is aligned with those.

Author: Nancy Tran

[1] PwC’s 19th Annual Global CEO Survey, pg 16, PwC

[2] State of Shared Value in Australia Survey, Shared Value Project and SVA, 2015

[3] Catalytic Philanthropy, Stanford Social Innovation Review, 2009

[4] The stages of CSR, CSR International

[5] CSR 3.0: A new global framework for responsible business, RSA, 2013

[6] Adapted from M. Kramer, ‘Catalytic Philanthropy’ (2009), Stanford Social Innovation Review; and M. Porter and M. Kramer, ‘Creating Shared Value’, ( 2011), Harvard Business Review.

[7] Measuring the value of corporate philanthropy, CECP, 2015

[8] Simplifying strategy: A practical toolkit for corporate societal engagement, FSG

[9] 2016 The State of CSR in Australia and New Zealand Annual Review: Pathway to the Sustainable Development Goals, ACCSR, 2016

[10] A guide to social impact at Westpac Group, Westpac