Bringing a financial wellbeing innovation to life

How a broad coalition of organisations worked together over six years to develop an innovative financial product to help pay for funerals. The Funeral Saver Safety Net gives a fair choice for people facing financial disadvantage including in First Nations communities where people can now take control of how they prepare financially for their funerals.

- With funerals costing on average around $9000, paying for a funeral has the potential to drive a family already experiencing financial difficulties into deep financial hardship.

- As a result, some families, particularly from First Nations communities, have sought to use funeral financial products. Unfortunately, some unethical providers have exploited these people.

- A coalition of organisations has developed a novel philanthropic offering, which is available alongside a savings instrument. It can provide a top-up payment if the participant has saved less than $5000 at time of death.

- The product known as the Funeral Saver Safety Net does exactly that, providing a safety net for those who have attempted to save for their funeral, thus providing a fairer choice in the market.

A few months ago, on a Thursday morning like any other, the Funeral Saver Safety Net (the Safety Net) quietly went live.

For anyone experiencing financial hardship, there is now an alternative, fairer way for them to prepare financially for their funeral.

The philanthropic Safety Net sits alongside an existing financial product, Australian Unity’s FuneralPlan Bond. Once someone is saving into the funeral bond, the Safety Net provides encouragement to stay on the savings journey and the potential for a top up payment if that person passes away before reaching the savings goal in their funeral bond.

This innovative concept took more than six years of development to launch into the Australian market.

So, let’s rewind to begin this story at its start.

The problem to solve

For anyone who has planned a funeral, the significant financial burden is well known. Average funeral costs were $8,800 when last reported in in 2022.1

But for many, the financial impact is far higher once you consider other key outlays such as a burial site, headstone, transport for the deceased back home, cultural rites, and hosting family and friends who need to attend the ceremonies.

Particularly in First Nations and some culturally and racially marginalised communities, these costs can easily surpass $15,000.

When this sort of financial shock hits a family already experiencing financial difficulties, the funeral costs can account for up to 30-40% of their annual income. Paying for a funeral has the potential to drive a family into deep financial hardship.

So, it comes as no surprise, that many families, particularly those from First Nations communities, have sought to ward off this risk with funeral financial products, such as funeral insurance or funeral expense products.

Unfortunately, there have been some unethical providers of these financial products who sought to exploit these people’s wish to manage that risk. As a result, some of these communities experienced:

- Paying more in premiums over their lifetime than the payout – this has been a particular issue in First Nations communities, with many applying for funeral products at a young age.

- Losing coverage by missing premium payments – financial counsellors report that many people in financial disadvantage do everything they can to maintain funeral premium payments (eg postpone other bills, skip meals), but a job loss or health costs can force people to miss several months of payments.

- Experiencing higher premium payments with age – many have experienced increased monthly premiums as they reach their 70s, 80s and 90s.

- Misunderstanding the nature of premium payments – financial counsellors report that people commonly believe that premium payments were in fact a contribution and they are accumulating these payments like savings.

One company, in particular, was synonymous with these experiences for First Nations peoples.

The Aboriginal Community Benefit Fund (ACBF), which changed its name to Youpla in 2019 (in the aftermath of the 2018 Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry), led people to believe that it offered funeral savings funds and that it was owned and run by Aboriginal people.

Neither was true.2 People paid many thousands of dollars in premiums over decades and were often convinced to ‘sign up’ family members from a young age – at one point, Youpla was estimated to have a third of customers aged under 15 years.3

Developing an innovative response

In 2017, these issues (particularly the actions of ACBF/Youpla) were of critical concern to consumer and community organisations and many financial services organisations. One influential working group4 was discussing the idea of creating a viable alternative in the form of a new, fairer financial product. The group commissioned Social Ventures Australia (SVA) to review the funeral landscape and consider options for a new financial product.

SVA worked with financial counsellors, community bodies and financial services organisations over 12-18 months, to articulate the key principles required of a new offering. Most importantly, it needed to:

- Be sensitive to the cultural needs of First Nations peoples

- Ensure that customers get back every dollar they put in (plus interest)

- Give people control and choice – so they can determine how long they pay into a funeral product, rather than be burdened by a lifelong commitment to monthly payments

- Have the potential to offer financial support if a person died before reaching a savings goal

- Reflect the financial situation of people experiencing disadvantage

- Be simple when families needed to receive the funds at the time of a funeral.

The Funeral Saver Safety Net concept began to crystallise. It combined savings with potential financial support (a Safety Net). The Safety Net would encourage people to keep on their savings journey, and provide a potential top up payment if they passed away before reaching $5,000 in savings. (This represented an achievable amount to save towards funeral costs.) SVA teamed up with Australian Unity and other supporters to bring this to life.

SVA played the backbone role: driving development of the solution and convening the necessary voices and participants. However, it was key for this new offering to be embedded within the financial services landscape and implemented by experienced and trusted organisations. And so the journey to bring the Safety Net to life began.

Sister project

Alongside the development of the Funeral Saver Safety Net has been a ‘sister’ project with Tender Funerals Australia and SEFA. The project replicates Tender Funerals Australia’s unique model of non-profit, community led funeral provision across Australia. (See the previous Quarterly article, The cost of dying and ABC Australian Story, A Community Undertaking.5 Tender Funerals has played a significant role in supporting the development of the Safety Net.

The long haul to bring this to life

A diverse range of organisations and skills worked together to translate the Safety Net concept. From SVA’s experience in building coalitions to tackle complex problems, we understood the key roles and expertise needed were:

- A dedicated funeral savings vehicle – Our research showed that a funeral bond would offer the necessary features e.g. protecting funds until someone’s death, and a product tailored for end-of-life experience.

- An operator/administrator with a suitable financial services licence and trusted brand – The two components (funeral bond and Safety Net) needed to be part of a single experience, particularly for bereaved families. It should be administered by an organisation with a strong track record with an existing funeral bond, as well as aligned in values with this initiative’s objectives. (Australian Unity, through its subsidiary Lifeplan Australia Friendly Society Limited, is one of Australia’s most experienced friendly societies.)

- Philanthropic support for Safety Net – Our research confirmed that the Safety Net top-up payments would need to be philanthropically funded, not part of a financial product.

- Custodianship of funds – The planned donations should be managed in trust by a reliable trustee provider that could work with the administrator.

- Funerals expertise – Knowledge of the funerals landscape was needed for ongoing input to the development of the offering

- Philanthropic support to implement – Funding was also needed to drive implementation.

- Legal support – We needed structures and agreements underpinning all these arrangements and pro-bono legal support to develop these.

- Community-facing experts – The Safety Net was most suited to conversations between community organisations and community members, rather than direct to consumers – so many relationships would need to be developed with those experts at the community level.

With the product still in development, we needed to find partners that were willing to help evolve the plan, take some risks and stay with us for however long this would take to bring to life.

By the end of 2019, most of the key relationships were in place with organisations such as Australian Unity, Tender Funerals Australia, Perpetual Trustees, Herbert Smith Freehills, and a range of other financial services donors and supporters. It was a bumpy road to negotiate – external events such as the Banking Royal Commission, the 2019-20 bushfire response, then Covid lockdowns, at times, threatened to curtail involvement and progress. Thankfully, these organisations remained on the journey.

The Funeral Saver Safety Net explained

For people experiencing financial disadvantage, the Funeral Saver Safety Net can provide a top-up payment to their existing funeral bond when they die, so that funeral expenses up to $5,000 are covered. The Safety Net is available for registrations alongside the FuneralPlan Bond (from Funeral Plan Management, a subsidiary of Australian Unity). The Safety Net is operated by Australian Unity, a mutual organisation, which provides the administration services pro-bono.

To be eligible for the Funeral Saver Safety Net top up payment, participants must have:

• been a FuneralPlan Bond customer for over a year

• have made regular contributions (saving the minimum contribution in at least nine out of every 12 months)

• saved less than $5,000 in contributions at the time of death.

Top-up payments from the Funeral Saver Safety Net are funded by a dedicated trust (the Funeral Benefit Trust, managed by Perpetual Trustees). This Trust was set up to encourage Australians experiencing financial disadvantage to plan and save for funeral costs. It receives donations from organisations that wish to support this goal.6

However, two of the most significant challenges were yet to come.

The Safety Net concept was discussed regularly with key government agencies, such as the Australian Securities and Investments Commission (ASIC). Once it was close to fully developed, final discussions with ASIC determined that this innovation (pairing philanthropic support with a currently regulated financial product) would also be deemed subject to all the regulatory requirements of a financial services product.

This could have defeated the concept in its entirety.

However we learned that an exemption from the requirements of the Corporations Act 2001 (relating to financial products) was possible. Pro-bono legal support from Herbert Smith Freehills guided SVA and Australian Unity expertly through this 18-month regulatory process, and the Safety Net emerged, largely intact, in July 2023.7

During this period, another factor emerged. In March 2022, ACBF/Youpla went into liquidation. Overnight, thousands of First Nations peoples lost their cover. For most, it felt like they had a lifetime of savings taken away, “inflicting significant cultural, emotional and financial harm on many First Nations people and communities”.8

Very quickly, a coalition of 130 consumer organisations and community bodies stood up to support and represent the victims affected – the Save Sorry Business Coalition.

Eighteen months of advocacy and negotiations followed between the coalition and government. This resulted in an enduring resolution for the victims of Youpla announced in October 2023,9 with financial resolution payments that could be accessed from July 2024.

Our marathon eventually reached the finishing tape in late March 2024. Australian Unity, the operator of the Funeral Saver Safety Net, released it onto the market.

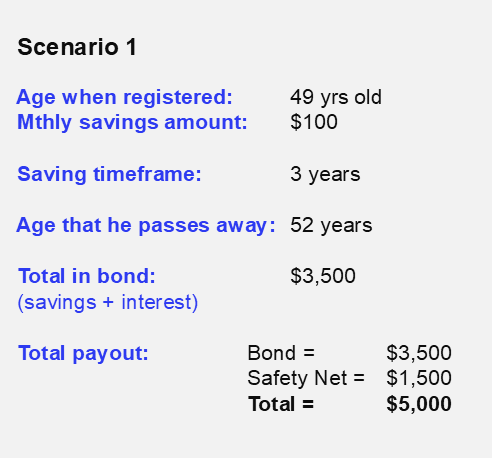

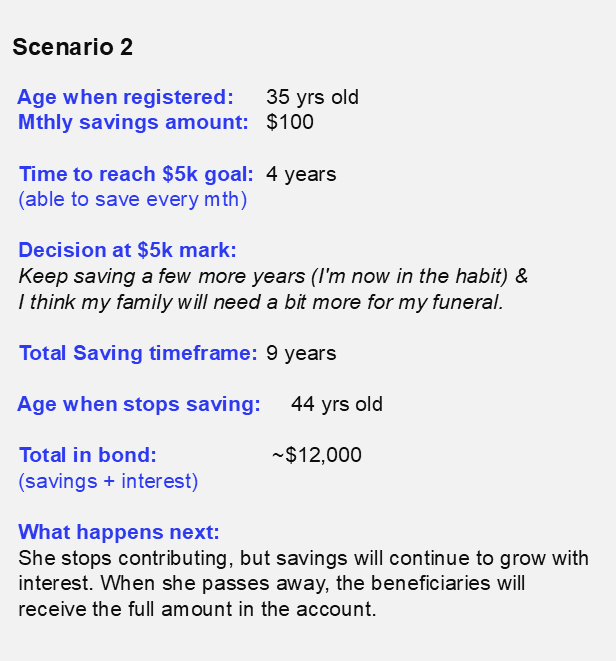

Examples of how the Safety Net might be used

Reflections on what it takes

We know that real change takes time. In this case, it meant a journey of six years to identify, design and bring to life an innovative response to an intractable problem. So, what did we learn about what it takes:

- Shared vision with partnering organisations – Our shared vision of the change we wanted to see – fairer choices for First Nations peoples and people facing financial disadvantage – maintained commitment from all parties. Australian Unity has dedicated significant time over five years, playing a pivotal role in bringing the product to life and is now managing ongoing operations pro-bono as part of its reconciliation objectives.

Adnan Glinac, Executive General Manager-Life at Australian Unity said that the social enterprise prioritised the project and drew on its forty-year track record providing funeral bonds to design a solution that was sensitive to the needs of First Nations Australians.

“We knew that one of the most meaningful ways our organisation could bridge the gap was to right the abject failings of Youpla and make sure it doesn’t happen again.

“The Funeral Saver Safety Net is a considered, culturally-sensitive and fit-for-purpose investment product that is the result of collaboration and care. It is an example of working together to meaningfully find ways to bridge the gap.” - Patient funding – A range of contributors from across the financial services sector provided funding to the project itself (in addition to the contributions of time noted above). Each funder has been open and willing to support an idea before it was fully formed or proven. For example, one financial services donor provided the initial funding for SVA to research the concept. Then, over the six years, the donors maintained unwavering support – financial and non-financial – to ensure that the Safety Net was achieved.

- Resilience and belief – Above all, it took belief from all involved. This included the countless financial counsellors and community organisations who gave their time and expertise along the way. Many times, they must have wondered about the progress, but they shared the belief that change was needed, and possible, and were always generous in helping craft the best response possible.

Where to from here?

So now, the next instalment of the journey begins. The focus shifts to raising more awareness about the Safety Net with financial counsellors and community organisations, so that they are in a position to explain this as an option to those who might benefit.

Another key focus will be to build funds in the Funeral Benefit Trust, so that impact can be scaled to more people. This will require more donors to understand the offering and make contributions to the Funeral Benefit Trust. It may well align with other organisations’ reconciliation goals.

For now, we can reflect on the achievement so far. There is a fairer choice available for people facing financial disadvantage across Australia. Particularly in First Nations communities, people can take control of how they prepare financially for their funerals.

Author: Louise Campbell

1 ABC News, Funeral prices show the cost of dying varies but does not have to be expensive, ABC website, Feb 2024, accessed Oct 2024.

2 ACBF/Youpla has faced three challenges from ASIC (in 1999 for misleading and deceptive conduct, in 2003 relating to anti-hawking and in 2020 for actions between 2015-18). In addition, over 170 people have had successful claims against ACBF/Youpla with the Australian Financial Complaints Authority.

3 ASIC, Report 454, Funeral Insurance: A snapshot, October 2015

4 Good Shepherd Financial Inclusion Action Plan Working Group

5 ABC Australian Story, A Community Undertaking, July 2022, ABC iview, accessed Oct 24

6 Australian Unity, Funeral Saver Safety Net Information Sheet, Australian Unity website, accessed Oct 24

7 ASIC, ASIC grants temporary relief for funeral saver safety net, ASIC website, July 2023, accessed Oct 2024.

8 National Indigenous Australians Agency, Resolution to the collapse of the Youpla Group, Australian Government Department of Prime Minister & Cabinet. , July 2024, accessed Oct 2024.

9 Save Sorry Business Coalition Media Statement: Latest extension of Youpla Interim Scheme must pave way for culturally appropriate scheme covering Centrepay victims, Financial Rights Legal Centre website, Oct 2023, accessed Oct 2024.