Putting tenants first: how Synergis Fund is investing in disability housing

Synergis Fund, a new fund investing in disability housing, is helping to fill a critical gap in the market by providing high-quality, long-term homes that meet tenants’ needs. How does the fund achieve this while still offering stable, risk-adjusted returns to its investors?

- Up to 50,000 people could be eligible for Specialist Disability Accommodation (SDA) funding once the National Disability Insurance Scheme’s roll-out is complete. This funding aims to stimulate investment in suitable disability housing.

- Social Ventures Australia and investment manager Federation Asset Management have established Synergis Fund, one of Australia’s first wholesale investment funds aimed at transforming disability housing. Its goal is to attract institutional capital to enable large scale investment in housing solutions.

- Synergis Fund works closely with other parties to understand and meet the tenants’ needs when developing homes. This mitigates vacancy risk and provides more secure returns to investors.

- Although this investment class is new, it has shown itself to be a strong proposition; it provides government-backed returns that are unaffected by economic cycles.

In 2011, the Productivity Commission estimated that around 28,000 people, representing 6% of National Disability Insurance Scheme (NDIS) participants, will require Specialist Disability Accommodation (SDA) funding once the scheme is rolled out. More recent estimates predict that closer to 50,000 people may require SDA.1 The Productivity Commission also estimated that at full scheme, from within the NDIS’ annual $22 billion budget, funding for SDA is expected to total approximately $700 million per year. These statistics point to the fact that a significant number of new homes are required to match these supply level estimates.

Disability housing from a tenant’s point of view

Read any SDA article and you’ll notice that these figures and statistics get bandied around on a regular basis. But what does the situation look like for individuals currently living in unsuitable accommodation?

Nick Gains is one of the many eligible for SDA. Twenty-five years old, he has quadriplegic cerebral palsy as well as an intellectual delay. Currently, he lives with his parents in north west Melbourne and is extremely keen to live independently – and has been for the last two years. His mother Joan Gains has been researching and looking for accommodation for the last decade.

“I’ve been his carer, his social secretary, his chauffer, a lot of things. I’d just like to be his mother.”

“We want to be sure that he is settled in accommodation that encourages his independence before I am no longer able to look after him. And he’s a young man, he wants his own space. He wants to be independent,” she says.

“I’ve been his carer, his social secretary, his chauffer, a lot of things. I’d just like to be his mother.”

The only option available until now has been housing in distant suburbs.

“He and his two friends want to live together, and they don’t want to be far away from their other friends, their networks, the hospital, their community. They’ve got used to the community and the community knows them. They don’t want to be isolated.”

If they don’t find anything and something happened to Joan Gains and her husband, an aged care establishment is the most likely option. “That’s not a home; that’s not for 25-year-olds.”

Another young man keen to live independently is Tyson Turner-Thomas, a 24-year-old who currently lives in a shared house in Silkstone, Ipswich, outside of Brisbane. An active member of his community, Turner-Thomas has cerebral palsy.

Many… live in completely inadequate accommodation, increasing their support costs and diminishing their opportunities.

He says that he didn’t have an option when he had to move out of home due to the support challenges of his disability. One of the things that he does want is “a home that is going to meet my needs both now and into the future”. He also wants that home to be closer to the community and things he loves.

“I want to live in the North Ipswich area, and possibly live with someone of similar age, interests and support needs,” he says.

Longevity of tenure is a critical feature on the wish list for disability housing. Prospective tenants want homes that are safe, closely connected to community, close to transport and other amenities, as well as to friends and family. Given in many cases housing is shared, homes also need to provide stability in terms of who might live there, as well as security of tenure for the future. Currently many people living with disability live in completely inadequate accommodation, increasing their support costs and diminishing their opportunities.

The SDA Supply report published by SVA and Summer Foundation estimates that as at September 2019 1,766 new SDA places were in development (an increase from the 1,518 reported in December 2018). However, according to the report there is still a shortfall of 7,750 places. Whilst the increase in development is encouraging, the report shows an undersupply in regional areas and where land acquisition costs are high (and therefore where profit margins will be lower).

There are different types of housing for different ability needs: basic, improved liveability, fully accessible, robust and high physical support. Buildings need to be approved prior to occupation and individuals must have SDA approved in their NDIS plans.

The report found that there has been a significant increase in high physical support apartments, but a gap in the supply of robust housing.

Lack of housing options for people living with a disability was the reason that SDA funding was established, designed to encourage significant investment into creating housing options. However, until recently investment has been slow.

Synergis Fund

Established by Social Ventures Australia and investment manager Federation Asset Management in 2019, Synergis Fund is managed jointly by both organisations and is one of Australia’s first wholesale investment funds aimed at transforming disability housing. Its goal is to attract institutional capital to enable large scale investment in housing solutions.

The two organisations bring complementary expertise: SVA’s social sector and impact investing skills, and Federation Asset Management’s institutional real estate experience, as well as a shared financial expertise.

The fund’s name reflects that its success depends on the synergy between financial returns and social impact and the cooperation between the fund, property developers and care providers.

Both the investment committee and board have representation from both organisations ensuring these complementary skills are present in its governance. The social and financial goals are written into the fund’s charter.

Synergis Fund’s objective is to build high-quality, safe, stable and appropriate homes for people with disability and in so doing, intends to set the industry standard for SDA property. The high-quality goal extends from construction quality to internal and external design aesthetics. The intention is to move away from the institutionalised model prevalent in legacy disability housing options, to building homes that residents choose and want to live in, and that compete well in any market – in addition to meeting the specific disability needs.

Myth#1 It’s the same as a residential property investment

The underlying assets held by the Synergis Fund are residential in nature, however from an investment perspective, they are not the same as a standard residential property investment. Because SDA is supported by long-term, budgeted payment streams from the Federal Government, they are more like a social infrastructure investment.

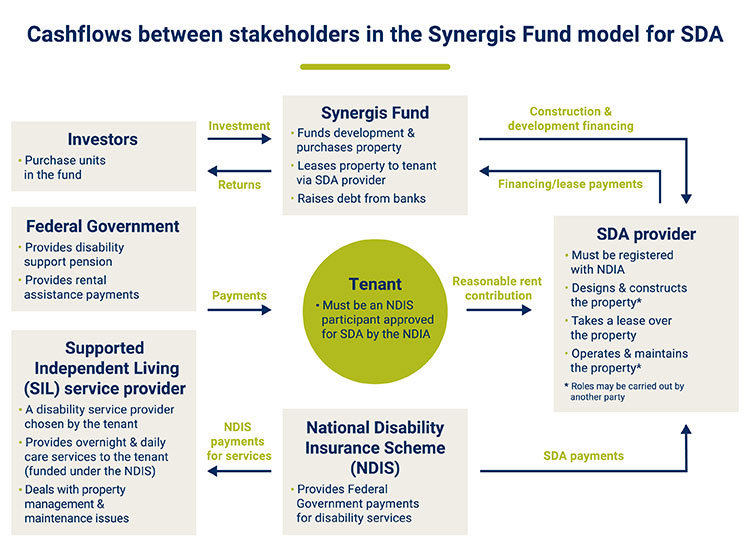

The investment fund is structured to be the long-term owner of the properties it invests in. It then leases the property to an SDA provider which maintains and manages the property on an ongoing basis, as well as managing relationships with the tenants and being accredited to collect SDA payments from the NDIA on the tenants’ behalf. The SDA provider can also be the developer and property manager, or may choose to outsource these functions.

Overnight and daily care services are provided by the Supported Independent Living (SIL) service provider that work together with the SDA provider to manage tenant relationships (given most of the properties are shared accommodation).

How Synergis Fund works

The fund receives rental payments that are predominantly funded by Federal Government-backed SDA payments, but also include additional payments from tenants funded through their disability pension, Commonwealth Rent Assistance or in some cases, other income. Financial returns are therefore driven primarily by the underlying SDA payments which are set in advance by the NDIA and modelled to take into account construction costs, the different design categories and location.

“… they had similar values to ours in wanting to create quality homes for people with disability that would maximise independence.”

Synergis Fund is building up close working relationships with a few key SDA providers and developers that align with the fund’s vision and values.

One such developer is Victoria-based Illowra Projects, which is working to build a home for Nick Gains and his co-tenants.

Owen Jourdian, Illowra Projects’ Managing Director, says “From the start when SVA was first discussing the initiative to create Synergis Fund, we were extremely excited as it was clear that they had similar values to ours in wanting to create quality homes for people with disability that would maximise independence.

“They also had a vision to invest for the long term which is important to Illowra as we too want to provide the security of a home for life.”

The fund’s close relationships with SDA providers and developers will enable it to build a portfolio of properties across various geographies, housing types (houses, duplexes, villas and apartments) and disability design criteria (robust, improved liveability and high physical support).

This diversity is a positive for investors as it spreads the financial risk across a number of properties, geographies and providers, to deliver attractive long-term, risk-adjusted returns.

It’s also a positive for SDA-eligible participants as it provides much greater choice and likelihood of meeting their needs. The resulting security of tenure is clearly beneficial for both individual tenants and the fund.

Not a cookie-cutter approach

Many housing developers have the capability to deliver residential projects, but building disability housing is not a ‘cookie-cutter’ process as Jourdian says.

“Our process starts by thoroughly understanding individual needs through as many sources as possible.”

“We pride ourselves on a person-centric approach to custom-designed disability housing. This respects the needs of individuals in locating, configuring and designing a home to maximise independence.

“Our process starts by thoroughly understanding individual needs through as many sources as possible. Feedback is widely sought from participants, family and formal supports on individual needs and design elements that will maximise independence to improve quality of life,” says Jourdian who was drawn to working in this sector 10 years ago after a colleague’s son suffered a brain injury and could find nowhere suitable to live, and other friends in the sector alerted him to the need.

All of the SDA providers and developers that Synergis works with are subjected to a rigorous due diligence process to demonstrate that they have a strong understanding of the disability services sector and established relationships with SILs – the organisations which provide the care services to support residents to live independently. Importantly, the fund supports the rights of participants to choose their SILs.

Individual investments are considered on a case-by-case basis. Decision-making takes into account financial returns, but also how the property will deliver on improved social outcomes for residents.

Myth #2 It’s too complex

Yes, SDA involves many different stakeholders but early engagement with all the parties is key to the success of the investments. Working closely and early with SDA providers, SILs and potential tenants ensures that the right type of property is built and that all requirements are included in the design. The later this engagement takes place, the higher the likelihood of building a home that is unable to be let or that could require costly modifications later.

A skills-based advisory committee is also being established to provide guidance, lived experience and sector expertise to the fund to help with the investment decisions.

Lee Carpenter, Deputy Chief Executive for Northcott (a SIL provider), sees the SIL providers discussing their existing needs and market opportunities directly with Synergis Fund, or a wider discussion between the SIL provider, the SDA developer and provider and the fund.

“It is essential that people have options…”

Either way there will be collaboration and bringing together of specialised skills and experiences to ensure that people get the home they need, SIL providers thrive, SDA providers grow their business and investors get a good return on their investment, as do Government, the NDIA and ultimately the tax payer.”

Given that under SDA funding, most people will be living together in a shared house, Carpenter stresses the need to ensure residents are well matched and suited to living together.

“It is essential that people have options, that they can select a home that offers them not just a great built environment in the right location, but with the right house-mates and with the right supports in place (SIL provider).”

Many also want to know if this can be their home for life.

For an SDA provider and developer like Illowra, this is where Synergis Funds’ long-term vision matters.

Jourdian from Illowra says: “We will be there to support participants into the future. By working with Synergis who own the homes, we are confident that we’ll be supported.”

One of the key risks of SDA investment is vacancy risk; SDA payments are paid only when a home is occupied (i.e. payments are attached to the individual not the property). Investing in homes that genuinely meet residents’ needs, significantly mitigates this vacancy risk.

Myth #3 SDA properties are hard to tenant

Managing vacancy risk is a key focus for investors. There are SDA properties sitting vacant for a host of reasons. However, if you understand the demand and you build good quality homes where they are wanted, vacancy risk is significantly mitigated.

Where is Synergis Fund up to?

Synergis Fund has recently completed its second close, bringing its total capital raised to $26.5 million from 15 investors. Investors in the fund include HESTA, Suncorp, Paul Ramsay Foundation and clients of Australian Impact Investments. We estimate that the capital raised will provide accommodation for 100 Australians living with disability, when combined with debt facilities that are being finalised.

This second close was achieved in April 2020 against the backdrop of the Covid-19 crisis, the shutdown of the economy and volatile equity markets. Although this investment class is new, it has shown itself to be a strong proposition; it provides government-backed returns that are unaffected by market or economic cycles.

HESTA’s senior investment analyst, Josephine Toral, explains HESTA’s approach, “Primarily our fiduciary duty is key, so we need to ensure that financial returns meet our objectives on a risk-adjusted basis. The way we review this is by understanding the risks and assessing them relative to other sectors in our investment portfolio. We believe that SDA is attractive for a portfolio given its regulated income structure.

“Even though the SDA sector is new, we believe that there is an opportunity to be a first mover in the market which will then create the opportunity to scale the sector overtime.

Myth #4 Investors are making large amounts of money

SDA payments have been designed to provide appropriate risk-adjusted returns to investors in the range of 11%, as per the SDA price guide. This isn’t an investment that will deliver 20% returns, despite what some financial advisors say. Returns are also subject to the homes being occupied and is not solely about the numbers set by NDIS in the SDA pricing table for new builds.

“Synergis has a strong commitment to work with SDA developers with a person-centric approach, with the prospective tenant at the centre ensuring longevity of tenancies,” says Toral. “We are seeking to work with groups that are looking at the investment not just from a bricks and mortar perspective but much more holistically to ensure the social impact objectives are met. So through working with the right partner this can help mitigate vacancy risk.”

Currently Synergis Fund is working with four SDA developers in Queensland, NSW, Victoria and South Australia: SDA Qld, Good Housing, Chapter 2, and Illowra Projects.

Over the next three years, Synergis Fund and Illowra Projects alone are targeting 50 new disability housing projects, with the potential to assist up to 200 people in need of housing.

The fund has approximately 50 properties under development or in the pipeline, with the first houses to be completed in August 2020.

“I felt included in all aspects of the build and final layouts.”

One of the homes in development is for Turner-Thomas in North Ipswich. With the help of his support coordinator (who assists him to connect to supports and services in the community), Turner-Thomas reviewed various SDA developers and landed on SDA Qld to build him a new home. “They were not only very friendly, but seemed to know their stuff.”

“They went out of their way to find options in the area I wanted to live. Once they’d secured a property that ticked all the boxes, they worked closely with my support coordinator, myself and the draftsmen to create a home on paper suited to my needs,” he says.

“I was involved in every possible step, even getting to choose my own colours, flooring and fixtures; I felt included in all aspects of the build and final layouts. It’s been exciting to exercise my choice and control in this regard.”

The home is due for completion early 2021 means that Turner-Thomas will be able to live more independently. “It will reduce my support needs and my transport bill significantly as I’ll be much closer to my regular activities,” he says.

What still needs to happen in the market

The National Disability Insurance Agency estimates that $5 billion in capital is needed to provide SDA for 12,000 participants to meet the NDIS goals. This 12,000 does not include people who are in substandard legacy housing that also needs replacing with quality stock. So, the potential investment needed is significantly greater.

Figures provided by the SDA Supply report show there’s still a long way to go. Close to 3,000 SDA places have been built or are now in the pipeline but demand is growing.

While investment from Synergis Fund and other funds in the sector goes some way to delivering the supply needed, a lot more capital and a lot more housing is needed.

Synergis Fund is targeted to invest $1 billion over the next five years. As the fund grows, the SDA developers will grow their capacity and experience, and as their expertise develops, economies of scale in terms of design and construction will be more available.”…

One of the reasons that Illowra Projects was keen to work with Synergis is because of its goal to scale its investments, says Jourdian. “This will enable Illowra to assist many more people.

“Illowra has grand goals to develop customised disability housing at scale through our person-centric approach. Synergis Fund has the ability to provide the capital to assist us to achieve these goals and improve the lives of many.”

Myth #5: There is already enough capital

Given the SDA market is designed to attract private capital, there is an assumption that capital is readily available to developers. This is not the case. Synergis Fund is one of a relatively small number of capital providers to the market. Given it will take $5-10 billion to provide the number of homes needed, significantly more capital is required and this will require the support of more large institutional investors.

Investors such as HESTA also see the potential in getting behind this new asset class.

“… there’s a huge untapped potential for the financial sector to both invest for a return and make a big difference in the lives of people with disability.”

Toral believes that housing will begin to follow international models where it will become a core part of a diversified property portfolio for institutional investors. “SDA on its own has a market estimated to be between $5-10 billion of capital needed to meet the SDA needs, and affordable housing more generally is a growing issue in Australia.”

There are certainly possibilities for new investment models being applied to affordable and social housing in the future, with institutional capital a way to unlock much needed supply. SDA has demonstrated that under-invested housing types can attract institutional investment when risk-adjusted returns are appropriate.

For now, Synergis Fund is focused on providing quality homes for people with disability and this is attracting investors with an eye to the future.

“One of our goals at HESTA is to encourage other large investors to make similar investments,” says Toral. “We believe there’s a huge untapped potential for the financial sector to both invest for a return and make a big difference in the lives of people with disability.”

Author: Rebecca Thomas

1 In 2018, Summer Foundation and SGS Economics & Planning published a report estimating that there are approximately 50,700 people that may require SDA. The figure comprises 17,500 people currently living in supported disability accommodation; 27,000 who are not living in supported accommodation but have very high support needs; and 6200 under the age of 64 who are living in residential aged care. Specialist Disability Accommodation: Market insights pg2, 2018