After 10 years of social impact bonds in Australia, we share insights and answer questions here in one place. SIB myths and legends. (Published 2022)

Social impact bonds and outcomes contracting services

Outcomes-based contracting is an approach that governments use to commission social services for a clearly defined target cohort with clearly defined outcomes. The performance of the service or program is measured relative to a baseline or counterfactual. In most cases, payments are linked the program’s performance as measured by the agreed outcome metrics. Social Impact Investments (in New South Wales and South Australia), Partnerships Addressing Disadvantage (in Victoria), payment by results (PbR) and payment by outcomes (PBO) are different names for outcomes-based contracts.

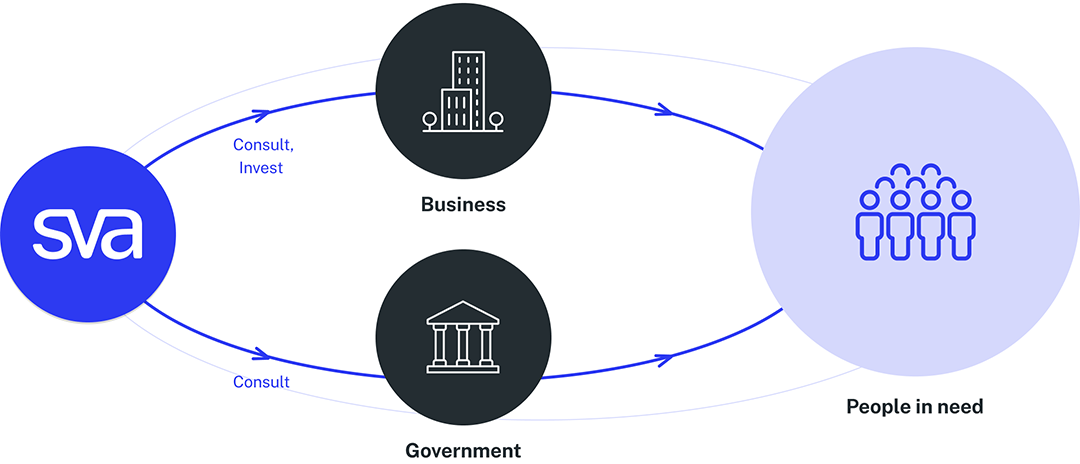

Our role as an advisor and intermediary is to support the end-to-end process of designing, negotiating and managing an outcomes–based contract, with or without a social impact bond – and to make the process as straightforward as possible.

As a non-profit organisation, we have a deep understanding of the aspirations and practical realities of the service delivery organisations we work with. We aim to make the process as straightforward as possible, with an unwavering focus on the end beneficiaries of the contract. Our team has deep commercial expertise and practical experience in designing, implementing and managing these types of contracts. SVA also holds an Australian Financial Services License. In short, we are comfortable navigating the space where social purpose meets high finance.

Our work is multi-faceted and includes advising service providers, governments and the investor community on the opportunities and practicalities involved in implementing outcomes-based contracts and social impact bonds.

The support we provide service delivery organisations and government covers the full spectrum from the exploration of an idea or developing a business case to the nitty-gritty of designing, negotiating and managing the contract:

Contract readiness support

- Business case development

- Capacity building and process advisory

- Program design and modelling

- Introductions to government and philanthropic contacts

- Measurement and evaluation frameworks to support ‘SIB readiness’

Proposal development

- Defining the target cohort

- Developing the intervention program logic and structure

- Selecting outcome metrics and estimating the baseline or counterfactual

- Analysis of program impact

- Refinement of operating model and program costs

- Financial modelling and designing payment structures

- Determining the optimal capital structure

- Proposal construction

- Joint Development Phase planning

Joint Development Phase

- Participation in negotiations with government, refining all project assumptions and commercial terms

- Working with lawyers to develop legal structures and documentation

- Raising any capital required (using SVA’s Australian Financial Services Licence)

- Setting up and registering appropriate legal entities

- Development of ongoing performance management, governance and reporting requirements.

Service Delivery Phase

- Ongoing investor reporting and financial management

- Program performance oversight and governance

- Management of any Special Purpose Vehicle, including Trustee services

If you are a service delivery organisation interested in exploring outcomes-based contracting and SIBs, please get in touch.

SVA also advises governments on the procurement of outcomes-based contracts and SIBs. If you represent a government organisation and would like to know how SVA could support your agency, please contact us.

If you are an investor interested in investing in SIBs or other impact investing products, please email us.

Target cohort

Defining the target cohort eligibility criteria, estimating baseline government costs and determining the number of eligible participants

Program design

Refining the proposed intervention model and determining program locations, scale, costs and duration

Outcome metrics

Defining outcome metrics, and determining a suitable counterfactual methodology and target level impact

Payment terms

Developing the financial model, and determining the mixture and timing of fixed and at-risk payments

Contract structure

Determining the contractual financing and risk management arrangements, and drafting legal contracts

Capital raise

Establishing the SIB special purpose vehicle, marketing the SIB (requires AFSL) and managing financial close

Ongoing governance

Supporting ongoing program oversight, providing investor reporting and supporting contractual reviews

What is a social impact bond?

SIBs provide a funding mechanism to enable social service providers to enter into outcomes-based contracts with government.

When a service provider enters into an outcomes contract, a portion of payments are dependent on the results achieved by the program. SIBs raise private investor capital to fund upfront service delivery costs and share in the financial risk of service providers achieving the targeted outcomes.

The general structure of a SIB is outlined below:

- Government enters into an outcomes contract to pay for services on an outcomes basis (rather than fee-for-service or block funding)

- Investors provide upfront capital to fund services and share performance risk

- A service provider delivers services to support people with specific needs

- Outcomes for the individuals enrolled in the program are measured, often compared to a baseline

- Government makes payments according to the outcome results achieved

- Outcome payments are used to repay investors and provide them with a return

If the service provider has sufficient capital and risk appetite, they may not need investor capital and the arrangement is an outcomes-based contract.

Articles and useful links

-

A guide to outcomes contracting and social impact bonds

A guide to outcomes contracting and social impact bonds -

Housing First: the challenges of moving from pilot to policy

Housing First: the challenges of moving from pilot to policyWith a growing body of evidence backing the highly supportive Housing First approach, including the recent evaluation of the Aspire SIB, why has it not been funded and adopted more extensively across Australia? (Published 2022)

-

A letter from the frontline

A letter from the frontlineAfter seven years ‘in the trenches’ as part of Australia’s foray into social impact bonds, Elyse Sainty shares her insights around SIB myths and legends. (Published 2019)

-

Social impact bonds: a tale of three Newpins

Social impact bonds: a tale of three NewpinsThe Newpin family reunification program has been deployed under the Social Impact Bond (SIB) mechanism in three states: one successful landing; one termination; one taking flight. SVA has been a key part of the crew on all three. So, what have we learned? +Podcast (Published 2021)

Our experts

Our team of passionate professionals have helped build the impact investing market in Australia.

-

Executive Director, Social Impact Initiatives Kirsten Armstrong

Executive Director, Social Impact Initiatives Kirsten Armstrong -

Associate Director, Commissioning for Outcomes Pat Bollen

Associate Director, Commissioning for Outcomes Pat Bollen -

Manager, Commissioning for Outcomes Emily Low

Manager, Commissioning for Outcomes Emily Low